Dallas 35/75 Industrial Portfolio :

Total square feet: 700,790 SF (Consists of 12 office/warehouse buildings)

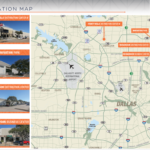

Trinity Mills Distribution Center 1430 Bradley Lane, Carrollton, Texas

Innovation Park 1201 Commerce Drive, Richardson, Texas

1299 Commerce Drive, Richardson, Texas

Richardson Distribution Center 1352-1366 Exchange Drive, Richardson, Texas

1355 North Glenville Drive, Richardson, Texas

1371 North Glenville Drive, Richardson, Texas

Richardson Business Center 601 North Glenville Drive, Richardson, Texas

655 North Glenville Drive, Richardson, Texas

675 North Glenville Drive, Richardson, Texas

670 International , Richardson, Texas

660 International , Richardson, Texas

650 International , Richardson, Texas

Site Location

PROPERTY DESCRIPTION

ACQUISITION PROCESS

Panther and ATCAP acquired DFW 35/75 on July 10, 2015. The portfolio was a collection of shallow bay warehouse and flex industrial properties located in the Northeast and Northwest Industrial submarkets of Dallas, TX (specifically Richardson, TX and Carrollton, TX). The portfolio was ideally situated along major Dallas thoroughfares including I-35E, Central Expressway (Hwy 75), and I-635. The buildings were constructed between 1978 and 1985 and consist of 700,790 square feet in 49 suites with an average size of 14,300 SF. We acquired the portfolio for $42,000,000, or $59.93 PSF. The original operating plan called for 5-year hold with a projected sale at $52,972,000 or $74.16 PSF, applying a 7.00% cap rate.

PROPERTY HISTORY

As a result of its strong performance leading up to, throughout, and subsequent to, the first COVID pandemic, the industrial category has become a very popular segment in which to invest, attracting both large institutions and local sponsors. 35/75’s strategic location in the heart of the strongest industrial market in the United States (DFW) positions it as an attractive portfolio for acquisition. Panther and ATCAP agreed that in order to maximize investor returns, the property should be included as part of a larger industrial portfolio to be marketed to institutional investors, who have the ability to pay premium valuations given they possess the lowest cost of capital.

35/75 was packaged for sale with 3 other investment portfolios by East Dil in July 2021. Panther was a part owner of 2 of the 3 other properties, specifically Denver Industrial (535,703 SF, Denver, CO) and ATCAP Fund I (2,110,005 SF – Dallas, Houston and Oklahoma City). The 4th property in the portfolio was a 181,688 SF property based in Austin and Houston known as Market Street where Panther was not involved. The total square footage of the offering was 3,529,423 SF. Prior to marketing the property for sale, we received Broker Opinions of Value (BOV) from East Dil along with ATCAP’s internal valuations on each of the underlying properties. The midpoint of the BOV for 35/75 was $83,00,000 or $118 PSF.

EXECUTION AND SALE

Panther investors achieved an average annual return of 24.1% and a multiple on invested capital (MOIC) of 2.53x over the 6.4-year holding period. These returns compare to our original underwriting of 13-15% average annual return over a 3-5 year holding period. At closing, Panther LP’s received a distribution equivalent to 2.02x of their original investment (previous distributions amount to .51x original investment – thus the total of 2.53x).

This sale exceeded our pro-forma projections albeit held longer than anticipated by providing a 2.53x multiple to Panther FW Investors and an annual average return on investment of 24.1% over the 6.4 year holding period.